U.S. Fiscal Policies: Navigating Economic Sustainability

The fiscal policies of the United States play a pivotal role in shaping the nation’s economic landscape. This article delves into the multifaceted aspects of U.S. fiscal strategies, exploring their historical context, contemporary implications, and the challenges and opportunities they present for ensuring economic sustainability.

Historical Overview of U.S. Fiscal Policies

Understanding the current state of U.S. fiscal policies requires a historical perspective. From the New Deal in response to the Great Depression to the Reaganomics of the 1980s, examining past fiscal approaches provides insights into the nation’s economic resilience and adaptability.

Explore the impact of United States Fiscal history on shaping the nation’s economic trajectory.

Contemporary Fiscal Priorities and Government Spending

Contemporary U.S. fiscal priorities are reflected in government spending patterns. Whether focused on infrastructure, healthcare, education, or defense, the allocation of resources reveals the administration’s vision for the nation’s development. Examining these spending priorities provides insights into the government’s strategic goals.

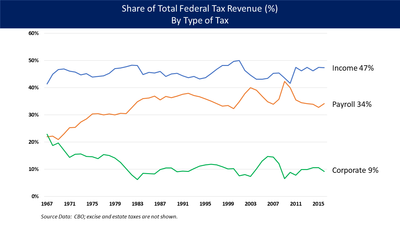

Taxation Policies and Economic Impacts

Taxation is a fundamental aspect of U.S. fiscal policies, influencing economic behavior and revenue generation. From income taxes to corporate levies, understanding the economic impact of taxation policies is essential for evaluating their effectiveness and societal implications.

Public Debt Dynamics and Fiscal Responsibility

Managing public debt is a perpetual consideration for U.S. fiscal policymakers. Striking a balance between necessary borrowing for essential programs and maintaining fiscal responsibility is crucial. Evaluating the approach to public debt management provides insights into the nation’s commitment to long-term fiscal health.

Monetary Policy Coordination and the Federal Reserve

U.S. fiscal policies are intricately linked with monetary policy, with the Federal Reserve playing a key role. Coordinating fiscal and monetary measures ensures a harmonized approach to economic stability. Analyzing this coordination sheds light on the mechanisms driving equilibrium in the U.S. economy.

Social Welfare Programs and Inclusivity

The inclusivity of U.S. fiscal policies is crucial for societal well-being. Examining how these policies address social welfare, income inequality, and support for vulnerable populations provides insights into the government’s commitment to creating an inclusive and equitable society.

Challenges in Contemporary Fiscal Management

The United States faces various challenges in contemporary fiscal management. From addressing income inequality to navigating global economic uncertainties, these challenges require strategic solutions and adaptive fiscal policies to ensure economic resilience.

Opportunities for Fiscal Innovation and Strategic Investments

While challenges exist, they also present opportunities for fiscal innovation and strategic investments. Whether in renewable energy, technology, or healthcare, identifying and capitalizing on these opportunities can drive economic growth and sustainability.

Global Economic Interdependence and Fiscal Diplomacy

As a global economic powerhouse, the U.S. engages in fiscal diplomacy and navigates international economic relationships. Participating in global forums, trade agreements, and diplomatic efforts contributes to the nation’s standing in the interconnected world of economics.

Conclusion: Charting a Sustainable Fiscal Future

In conclusion, navigating the complexities of U.S. fiscal policies requires a nuanced understanding of historical contexts, adaptive responses to contemporary challenges, and a commitment to long-term sustainability. Examining fiscal policies provides a lens through which we can evaluate the nation’s economic resilience and its trajectory toward a sustainable fiscal future.