[ad_1]

For many people, buying a home is a dream come true. It’s a significant investment that offers stability, security, and a sense of accomplishment. Homeownership comes with various benefits, including tax breaks, equity, and the freedom to customize and renovate your living space. However, being a homeowner also means understanding your rights and responsibilities. In this article, we will discuss the ins and outs of homeownership, including your legal rights as a homeowner.

Lender and Realtor Disclosure Requirements

When buying a home, you will work with a mortgage lender and a real estate agent or broker. Both parties must disclose certain information to you in writing. According to federal law, lenders are required to provide you with important information about the loan, such as the interest rate, loan amount, payment terms, and closing costs. The real estate agent must provide you with a disclosure document that outlines their relationship with you, the buyer, and the seller.

Right to Privacy

As a homeowner, you have the right to privacy in your own home. This means that no one can enter your property without your permission unless there is a court order or emergency situation. Furthermore, you can refuse entry to anyone, including law enforcement, without a warrant or probable cause. However, if you rent out space in your home, such as a basement apartment, you may have limited privacy rights.

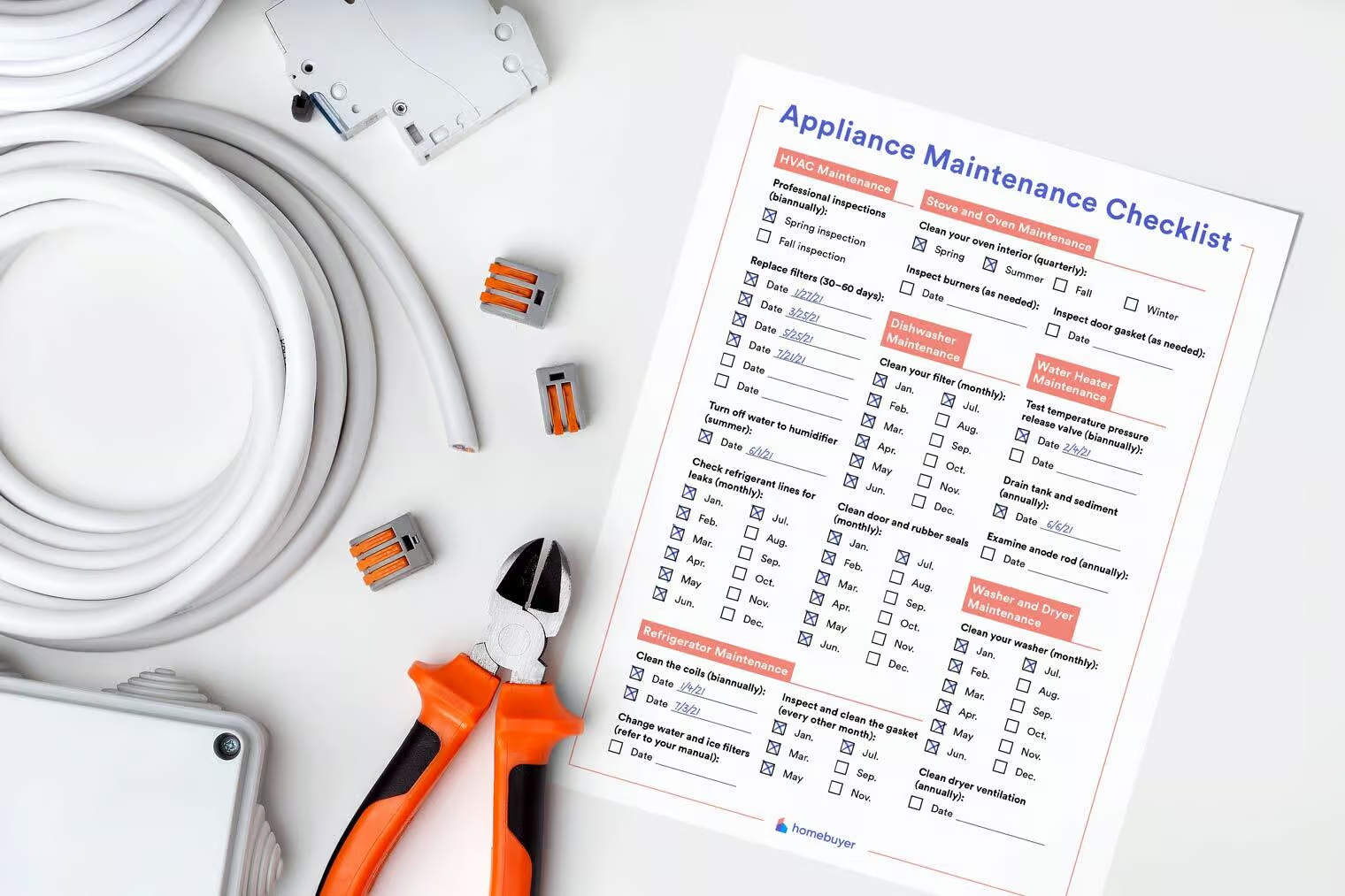

Property Maintenance and Repairs

One of the most significant responsibilities of homeownership is property maintenance and repairs. As a homeowner, you are responsible for keeping your property in good condition and ensuring that it meets local codes and regulations. This includes tasks like yard maintenance, plumbing, electrical work, and roof repairs. If you fail to maintain your property, your neighbors may complain, and you could face legal action.

Homeowner’s Insurance

Homeowner’s insurance is an essential component of homeownership. It protects your property and financial interests from damage or loss caused by natural disasters, theft, and other risks. You have the right to choose your insurance provider and coverage levels. However, your lender may require you to maintain a certain level of coverage to protect their investment.

Homeowner’s Association

If you buy a property within a community or development, you may be subject to a homeowner’s association (HOA). An HOA is a group of homeowners who manage and regulate common areas and amenities, such as pools, clubhouses, and parks. As a member of an HOA, you have certain rights and responsibilities. You may be required to pay monthly or annual dues, follow specific rules and regulations, and attend meetings.

Conclusion

Owning a home comes with many benefits, but it also comes with significant responsibilities. Understanding your rights and responsibilities as a homeowner is crucial to maintaining a successful and enjoyable homeownership experience. By keeping up with property maintenance, choosing the right insurance, working with reputable lenders and real estate agents, and understanding your rights, you can enjoy all the benefits of homeownership with fewer headaches and hassles.

[ad_2]