Navigating Inflation Rate Trends: A Comprehensive Analysis

Inflation has always been a key economic indicator, influencing everything from consumer spending to investment strategies. Understanding inflation rate trends is crucial for individuals, businesses, and policymakers alike. In this article, we’ll delve into the intricacies of inflation, examining its impact on various aspects of the economy.

The Basics of Inflation

Inflation, in its simplest terms, refers to the general increase in prices for goods and services over time. It erodes the purchasing power of a currency, leading to a reduction in the value of money. Central banks often target a specific inflation rate to maintain economic stability.

Inflation can be caused by various factors, including increased demand, supply chain disruptions, or changes in production costs. Central banks closely monitor these factors to gauge the overall health of the economy.

Impact on Consumer Spending

One of the immediate effects of inflation is its impact on consumer spending. As prices rise, consumers may cut back on discretionary expenses, leading to changes in buying patterns. This shift in consumer behavior can have widespread implications for businesses, influencing production levels and employment rates.

Investment Strategies in an Inflationary Environment

For investors, understanding inflation rate trends is crucial for devising effective investment strategies. Inflation erodes the real returns on investments, making it essential to choose assets that can outpace inflation. Investments such as real estate, commodities, and certain stocks are often considered hedges against inflation.

Government Policies to Combat Inflation

Governments and central banks employ various policies to control inflation. These may include adjusting interest rates, implementing fiscal policies, or intervening in currency markets. The effectiveness of these measures depends on the specific economic conditions at play.

Global Perspectives on Inflation

Inflation is not confined to national borders; it’s a global economic phenomenon. Understanding inflation rate trends on a global scale is essential for businesses engaged in international trade and investors with diverse portfolios. Factors such as exchange rates and global supply chains play a significant role in shaping inflation dynamics.

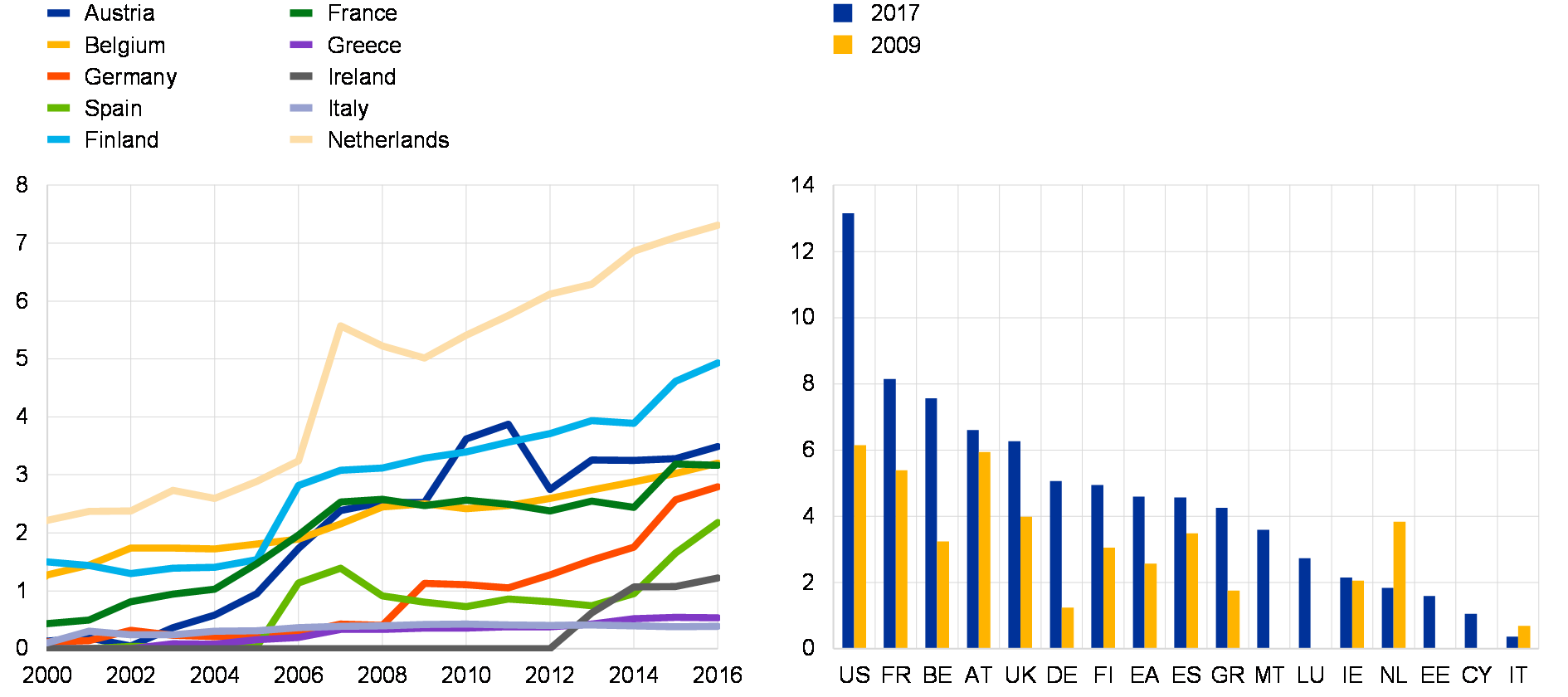

Inflation Rate Trends: A Historical Perspective

Examining historical inflation trends provides valuable insights into how economies have navigated inflationary periods in the past. Lessons from history can inform policymakers and businesses on potential strategies to mitigate the impact of inflation.

To explore current Inflation Rate Trends, visit Inflation Rate Trends for up-to-date information and analysis.

Inflation and Interest Rates

Inflation and interest rates are intricately linked. Central banks often use interest rate adjustments to control inflation. Higher interest rates can help curb inflation by reducing consumer spending and investment, while lower rates may stimulate economic activity during periods of low inflation.

The Role of Technology in Inflation Management

Technological advancements can influence inflation trends by improving productivity and efficiency. Innovation in production processes and the use of technology to streamline supply chains can contribute to price stability.

Adapting to Inflation: Strategies for Businesses and Individuals

In a constantly evolving economic landscape, businesses and individuals need to adapt to inflationary pressures. This may involve reevaluating budgetary allocations, renegotiating contracts, or exploring alternative investment opportunities.

In conclusion, understanding inflation rate trends is essential for making informed economic decisions. Whether you’re an individual investor, a business owner, or a policymaker, staying abreast of inflation dynamics enables you to navigate economic challenges effectively. Keep a close eye on the latest trends and consider the implications for your financial strategies.