Understanding Economic Inflation: A Comprehensive Exploration

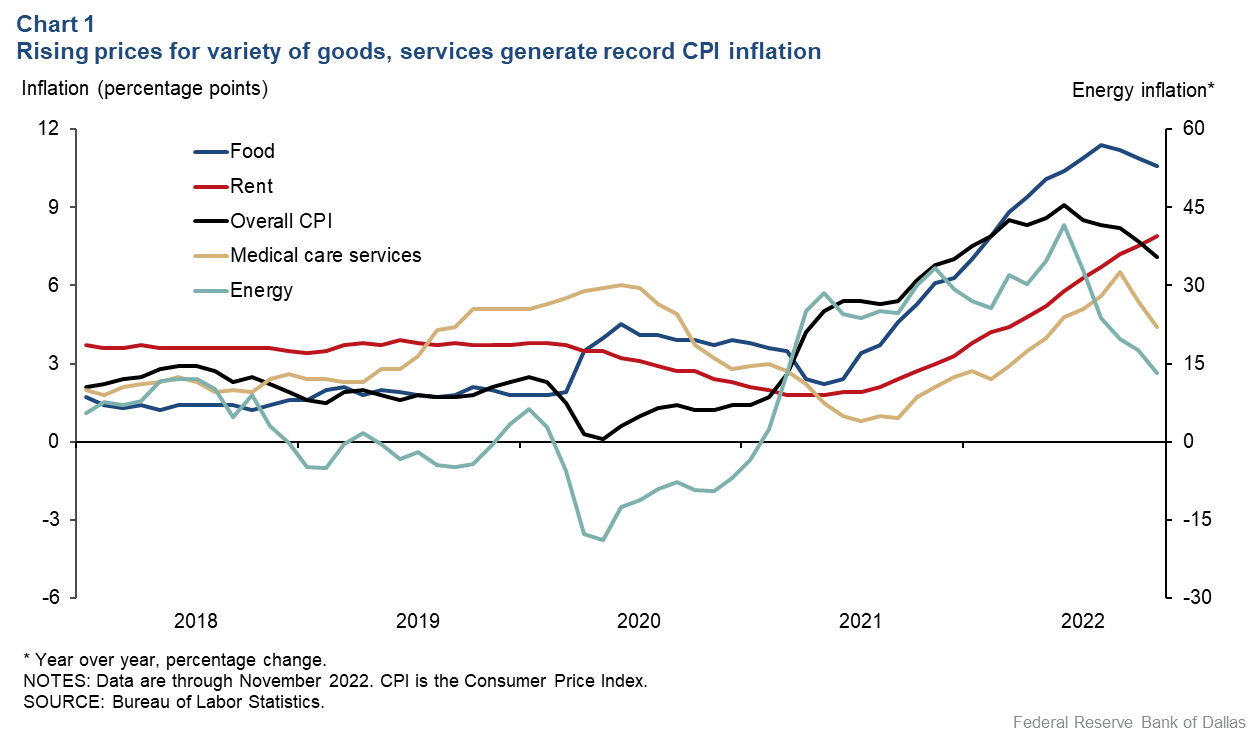

Economic inflation, the rise in the general price level of goods and services, is a complex phenomenon with broad-reaching implications. In this article, we embark on a journey to unpack the intricacies of economic inflation, examining its impact on consumers, businesses, investments, and the strategies to navigate its challenges.

Consumer Dilemmas: Erosion of Purchasing Power

One of the most immediate impacts of economic inflation is the erosion of consumer purchasing power. As prices escalate, each unit of currency buys less, leading to diminished purchasing power for individuals. This phenomenon poses a significant challenge to maintaining the same standard of living, impacting households and their financial stability.

Fixed-Income Struggles: Challenges for Vulnerable Groups

Fixed-income earners, including retirees and those on fixed salaries, face heightened challenges during periods of economic inflation. Their fixed incomes become less sufficient as the cost of living rises, highlighting the vulnerability of these groups. Addressing the unique challenges they face becomes essential for a holistic understanding of the economic inflation impact.

Businesses Under Pressure: Escalating Costs and Margins

Businesses grapple with the direct consequences of economic inflation as their operational costs escalate. The prices of raw materials, labor, and other essential inputs often surge, squeezing profit margins. Small and medium-sized enterprises, in particular, may find it challenging to adapt swiftly, potentially leading to operational challenges or closures.

Interest Rates and Investments: A Delicate Balance

In response to inflation, central banks may adjust interest rates to stabilize the economy. Higher interest rates can impact investment decisions, making borrowing more expensive. This has the potential to slow down business investments and capital expenditures. Understanding the intricate relationship between inflation, interest rates, and investments is crucial for businesses and investors alike.

Asset Value in Flux: Preserving Wealth Amidst Inflation

The real value of assets can be affected by economic inflation. While financial assets like stocks may provide a hedge against inflation, certain physical assets like cash or fixed-rate bonds may see a decline in real value. Investors need to navigate this landscape carefully, considering diverse investment strategies to preserve and grow their wealth.

Global Trade Dynamics: Influence of Currency Fluctuations

Inflation’s impact extends beyond domestic borders, influencing global trade dynamics. Exchange rates may fluctuate as countries experience varying inflation rates. Understanding these currency dynamics is essential for businesses engaged in international trade, as it directly affects the competitiveness of exports and the cost of imported goods.

Policy Responses: Inflation Targeting and Beyond

Governments and central banks employ various policy responses to mitigate the economic inflation impact. Inflation targeting, a monetary policy strategy, aims to maintain a specific inflation rate for economic stability. Analyzing these policy responses provides insights into the measures taken to balance economic growth and price stability.

Social Inequality Exacerbation: Disproportionate Impact

Inflation can exacerbate existing social inequalities. Low-income households, with a higher proportion of spending on necessities like food and housing, may bear a disproportionate burden. Analyzing the social dimensions of inflation is crucial for policymakers to design inclusive economic policies that address the needs of diverse socioeconomic groups.

Navigating Strategies: Diversification and Risk Management

To navigate the economic inflation impact, individuals and businesses should adopt diversified strategies. This includes investments in assets that historically perform well during inflationary periods, such as real estate or commodities. Additionally, financial planning and risk management become essential tools for mitigating the adverse effects of rising prices.

Exploring Insights and Solutions

For comprehensive insights into navigating the economic inflation impact and exploring potential solutions, consider visiting Economic Inflation Impact. This resource offers valuable information on inflation trends, policy analyses, and strategies for individuals and businesses to adapt to the evolving economic landscape.

Conclusion: The Ongoing Balancing Act

In conclusion, economic inflation is an ongoing balancing act with multifaceted implications. From consumers and businesses to policymakers and investors, understanding the complex nature of inflation is paramount. By adopting adaptive strategies, informed decision-making, and a nuanced approach to economic policies, societies can navigate the delicate balancing act posed by inflation and strive for sustainable economic growth.