Inflation Impact: Navigating Rising Prices in the USA

In recent times, the United States has grappled with a noticeable increase in inflation, leading to concerns about its implications on the economy and daily life. This article delves into the factors contributing to rising prices in the USA, explores its effects, and suggests strategies for navigating through this economic landscape.

Understanding Inflation Dynamics: A Complex Web

Inflation is a complex economic phenomenon, influenced by various factors. Demand-pull inflation occurs when consumer demand outstrips the supply of goods and services, leading to price increases. Cost-push inflation results from rising production costs, such as increased wages or higher raw material prices. Both dynamics contribute to the inflationary pressures observed in the USA.

Global Supply Chain Challenges: Disruptions and Shortages

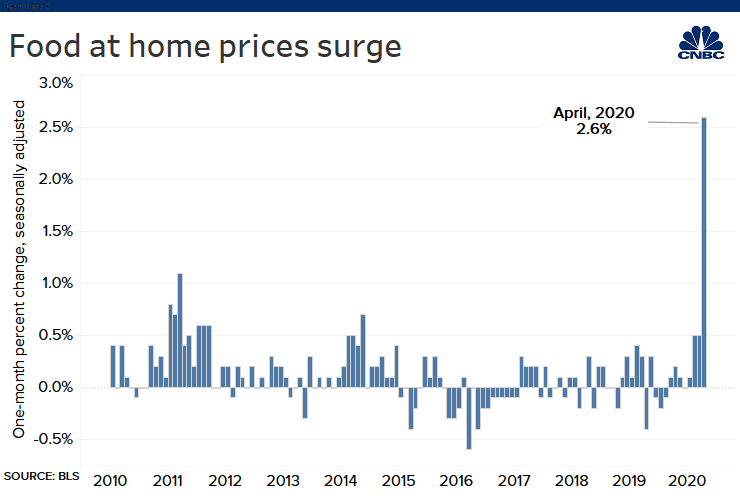

Global supply chain challenges have played a significant role in driving up prices in the USA. Disruptions caused by the COVID-19 pandemic, transportation bottlenecks, and shortages of critical components have created a domino effect, affecting the availability and cost of goods. This has contributed to inflationary pressures across various sectors of the economy.

Energy Price Volatility: A Key Contributor

The volatility of energy prices is a critical factor influencing inflation. Fluctuations in oil and gas prices, influenced by geopolitical events and market dynamics, directly impact production and transportation costs. As energy costs rise, businesses may pass these expenses on to consumers, leading to higher prices for goods and services throughout the country.

Housing Market Trends: Impact on Inflation

The housing market is a crucial element in the US economy, and its trends significantly impact inflation. Soaring property values, driven by high demand and limited housing supply, contribute to rising rental costs and associated housing-related expenditures. These trends add to the overall inflationary pressures experienced by consumers.

Labor Market Dynamics: Wage Pressures and Inflation

Labor market dynamics play a dual role in the inflation equation. On one hand, increased demand for workers can lead to wage pressures as businesses compete for talent. On the other hand, rising wages can contribute to higher production costs, potentially fueling inflation. Balancing these dynamics is crucial for maintaining a stable economic environment.

Monetary Policy Challenges: Federal Reserve’s Dilemma

The Federal Reserve plays a pivotal role in managing inflation through monetary policies. However, determining the appropriate course of action is challenging. Aggressive measures to curb inflation may impact economic growth, while a more lenient approach may allow inflation to spiral out of control. Striking the right balance is a delicate task for policymakers.

Consumer Impact: Coping with Higher Prices

Consumers feel the direct impact of rising prices in their daily lives. Higher costs for goods and services, from groceries to fuel, can strain household budgets. Implementing strategies such as budgeting, seeking cost-saving alternatives, and exploring investment opportunities that outpace inflation can help consumers navigate through the financial challenges posed by rising prices.

Business Strategies: Adapting to Economic Realities

Businesses must adapt to the economic realities of rising prices. This may involve adjusting pricing strategies, exploring cost-saving measures, and optimizing supply chain operations. Innovation and flexibility are key components of business strategies aimed at mitigating the impact of inflation on operations and maintaining competitiveness.

Navigating Uncertain Times: Strategies for Individuals

In uncertain economic times, individuals can adopt strategies to navigate through rising prices. This includes staying informed about economic trends, diversifying investments, and considering avenues for additional income. Smart financial planning, prudent budgeting, and being proactive in adjusting to changing circumstances contribute to individual financial resilience.

Looking Ahead: Economic Outlook and Resilience

As the USA faces the challenges of rising prices, looking ahead involves assessing the economic outlook and fostering resilience. Continuous monitoring of economic indicators, staying informed about policy decisions, and adapting to evolving circumstances are essential for individuals, businesses, and policymakers alike in navigating through uncertain economic times.

Explore more insights on Rising Prices in the USA at firstbisnisku.my.id. Stay informed about economic trends, understand their implications, and adapt your financial and business strategies to effectively navigate the challenges posed by rising prices in the USA.