Financial Harmony: Optimizing Household Financial Planning

Maintaining financial stability at the household level is a fundamental aspect of a secure and prosperous future. This article explores the importance of household financial planning, delving into key strategies, budgeting techniques, and investment considerations to achieve financial harmony.

The Foundation: Setting Clear Financial Goals

Effective household financial planning begins with setting clear and realistic financial goals. Whether it’s saving for a home, education, retirement, or emergencies, defining these goals provides a roadmap for crafting a comprehensive financial plan. Identify short-term and long-term objectives to guide your financial decisions.

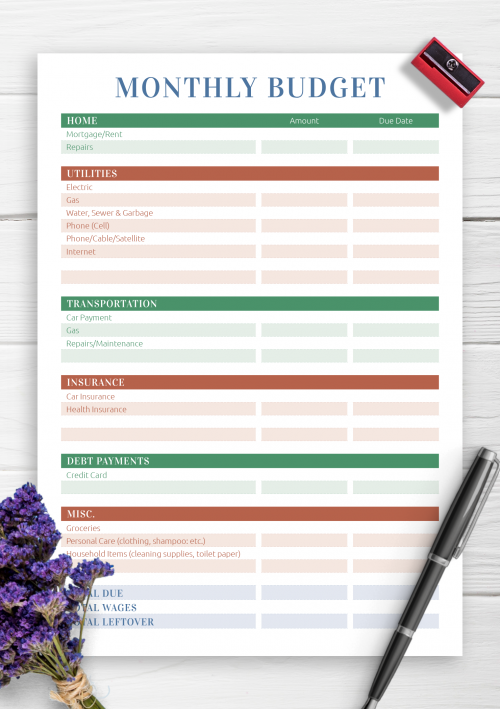

Budgeting Wisdom: Mastering Income and Expenses

A cornerstone of successful household financial planning is mastering the art of budgeting. Track income sources and categorize expenses meticulously. Allocate funds for essentials, savings, and discretionary spending. Regularly reviewing and adjusting the budget ensures financial alignment with evolving priorities and circumstances.

Explore the impact of Household Financial Planning for a secure financial future.

Emergency Funds: Shielding Against Financial Storms

Building an emergency fund is a crucial component of household financial planning. This financial safety net provides a buffer against unexpected expenses such as medical emergencies, car repairs, or job loss. Aim for three to six months’ worth of living expenses in your emergency fund for added financial security.

Debt Management: Striving for Financial Freedom

Effectively managing and reducing debt is pivotal for financial harmony. Prioritize high-interest debts, such as credit cards, and consider debt consolidation strategies if feasible. Striving towards a debt-free status enhances financial flexibility and accelerates progress towards long-term financial goals.

Investment Strategies for Wealth Accumulation

Household financial planning extends beyond savings to strategic wealth accumulation through investments. Explore diverse investment vehicles, such as stocks, bonds, mutual funds, and real estate, aligning them with your risk tolerance and financial objectives. Regularly review and rebalance your investment portfolio as market conditions evolve.

Insurance Coverage: Safeguarding Financial Well-Being

Incorporating insurance into your household financial planning safeguards against unforeseen events. Evaluate life insurance, health insurance, property insurance, and other coverage options to ensure comprehensive protection for your family’s financial well-being. Regularly review and update your insurance policies as your circumstances change.

Retirement Planning: Securing Your Golden Years

Thoughtful retirement planning is a key aspect of household financial planning. Estimate your retirement needs, contribute to retirement accounts consistently, and explore employer-sponsored plans or individual retirement accounts (IRAs). Starting early and maximizing contributions can significantly impact your financial security during retirement.

Education Funding: Investing in Future Generations

For families with education goals, incorporating education funding into household financial planning is essential. Explore options like 529 savings plans, Coverdell Education Savings Accounts (ESAs), and other tax-advantaged accounts. Planning ahead ensures that educational expenses align with your overall financial strategy.

Regular Financial Check-Ups: Adapting to Change

Life is dynamic, and so should be your household financial plan. Schedule regular financial check-ups to assess progress, adapt to life changes, and realign financial goals. Celebrate milestones, tweak strategies as needed, and stay proactive in optimizing your financial well-being.

Financial Literacy: Empowering Informed Decision-Making

A cornerstone of effective household financial planning is financial literacy. Continuously educate yourself about personal finance, investment strategies, and economic trends. Empowering yourself with financial knowledge enhances your ability to make informed decisions, ensuring the resilience of your financial plan.

Conclusion: Achieving Financial Serenity

In conclusion, achieving financial harmony through household financial planning involves a holistic approach. Setting clear goals, mastering budgeting, and embracing strategic financial practices pave the way for a secure and prosperous future. By prioritizing financial literacy and adapting to change, households can navigate the complexities of personal finance with confidence and serenity.