Deciphering Inflationary Forces: Navigating Economic Realities

In the intricate web of economic factors, understanding inflationary forces is paramount for individuals, businesses, and policymakers alike. This analysis delves into the multifaceted nature of inflation, exploring its impact and strategies for effective navigation.

Unraveling the Complexity of Inflation

At its core, inflation represents the persistent increase in the general price level of goods and services over time. To comprehend its implications, it’s crucial to unravel the complexity of factors contributing to inflationary forces. This involves examining demand-pull inflation, cost-push inflation, and the interplay of various economic components.

Impact on Everyday Lives: Purchasing Power Dynamics

One of the most tangible effects of inflation is its impact on the purchasing power of individuals. As prices rise, the value of money diminishes, influencing consumer behavior and spending patterns. This shift in purchasing power has cascading effects on households, influencing budgetary decisions and financial planning.

Central Banks and Monetary Policy: Guardians Against Inflation

The guardians against inflationary pressures are central banks, armed with monetary policy tools. Analysis of interest rates, money supply, and other policy mechanisms provides insights into the effectiveness of central banks in maintaining price stability. Striking the right balance becomes a delicate dance between economic growth and inflation control.

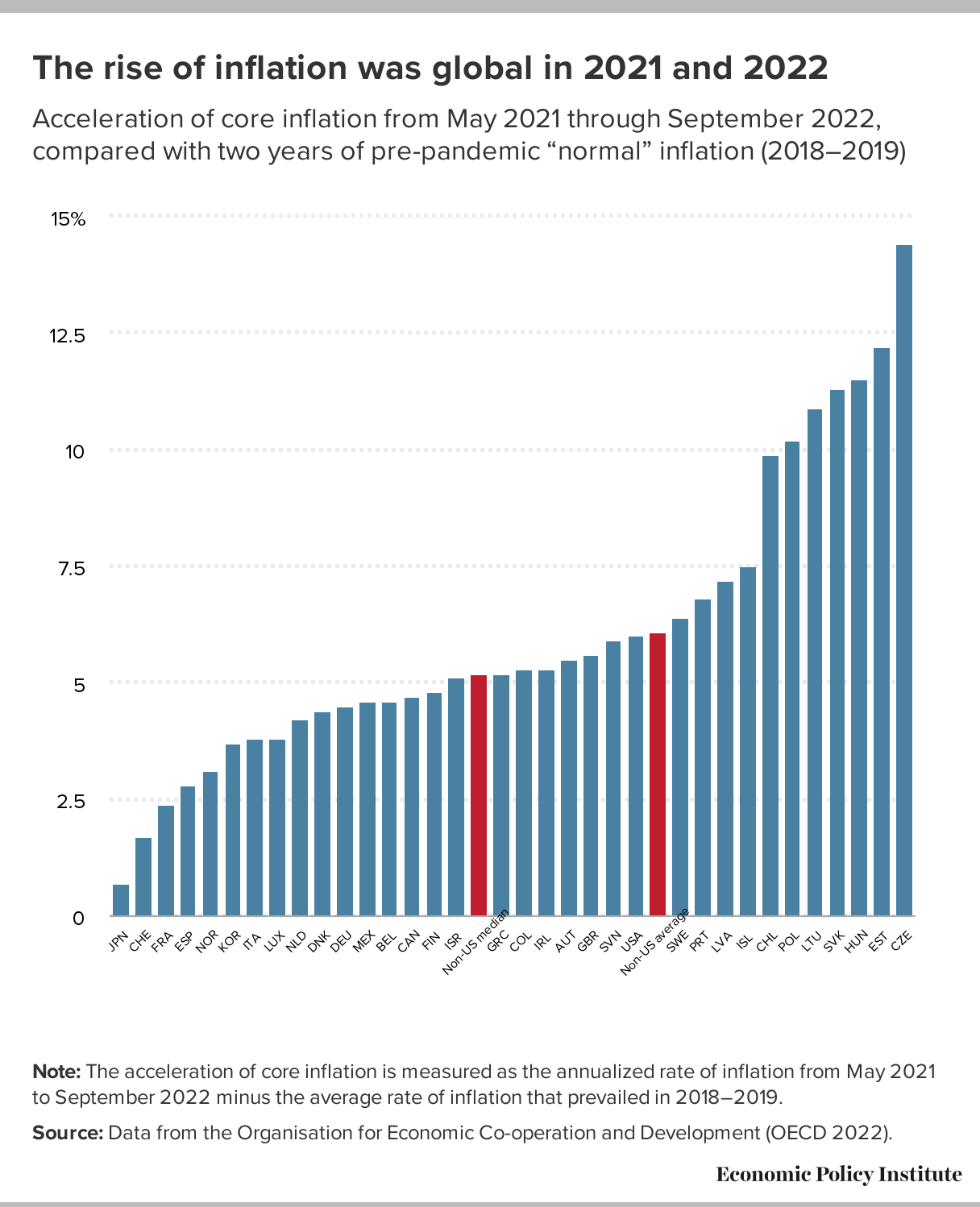

Global Interconnectedness: Inflation Beyond Borders

Inflationary forces are not confined within national borders; they echo globally. The interconnected nature of economies, international trade, and monetary policies means that inflation in one part of the world can have ripple effects elsewhere. A comprehensive analysis must consider the global economic dynamics at play.

Strategies for Investors: Adapting to Inflationary Environments

Investors face a unique challenge during periods of inflation. Asset classes respond differently to inflationary pressures, necessitating diversified investment strategies. Commodities, real estate, and other hedges become focal points for investors seeking to safeguard their portfolios against the erosion of real returns.

Labor Market Dynamics: Wage Inflation and Its Implications

Within the inflationary landscape, labor market dynamics play a crucial role. Wage inflation, driven by factors such as increased demand for skilled workers, adds another layer to the overall inflation picture. Understanding these dynamics aids in predicting broader economic trends and their consequences.

Consumer Sentiment: Shaping Inflation Expectations

Consumer sentiment and expectations are influential factors in the inflationary equation. Analyzing how consumers perceive inflation, their expectations for the future, and subsequent behavioral changes provides valuable insights. This understanding is instrumental for businesses and policymakers in crafting responsive strategies.

Government Measures: Balancing Fiscal Policies

Governments deploy various measures to mitigate inflationary pressures. Fiscal policies, including taxation and government spending, are pivotal tools. Analyzing the effectiveness of these measures provides a gauge of a government’s ability to balance economic growth with inflation control.

Business Resilience: Challenges and Opportunities

Inflationary forces present challenges for businesses, affecting production costs, pricing strategies, and overall competitiveness. However, astute businesses can identify opportunities amid inflation by adapting strategies, optimizing costs, and exploring innovative solutions to maintain resilience in dynamic economic environments.

Informed Decision-Making: Navigating Economic Realities

In conclusion, a comprehensive understanding of inflationary forces is a cornerstone for informed decision-making. To explore further insights on this crucial economic topic, visit Inflationary Forces Analysis. Navigating economic realities requires a nuanced approach, and staying informed is key to adapting strategies for both personal and business financial success.