Unraveling Inflation: A Comprehensive Analysis

Inflation, a persistent increase in the general price level of goods and services, is a crucial economic indicator that requires a thorough examination. Delving into the dynamics of inflationary forces provides insights into its impact on economies and individuals alike.

Understanding the Factors Behind Inflation

To analyze inflationary forces, one must first understand the factors contributing to its occurrence. Demand-pull inflation, cost-push inflation, and built-in inflation are common drivers. By dissecting these elements, economists can gauge the root causes and formulate strategies for effective management.

Impact on Consumer Purchasing Power

Inflation directly impacts the purchasing power of consumers. As prices rise, the value of money diminishes, leading to a decrease in the real purchasing power of individuals. This phenomenon has widespread implications for both everyday consumers and businesses, influencing spending patterns and budgetary considerations.

Central Role of Monetary Policy

Central banks play a pivotal role in controlling inflation through monetary policy. Analyzing interest rates, money supply, and other policy tools helps assess the effectiveness of central banks in managing inflation. The delicate balance between stimulating economic growth and curbing inflation remains a central challenge for policymakers.

Global Economic Perspectives

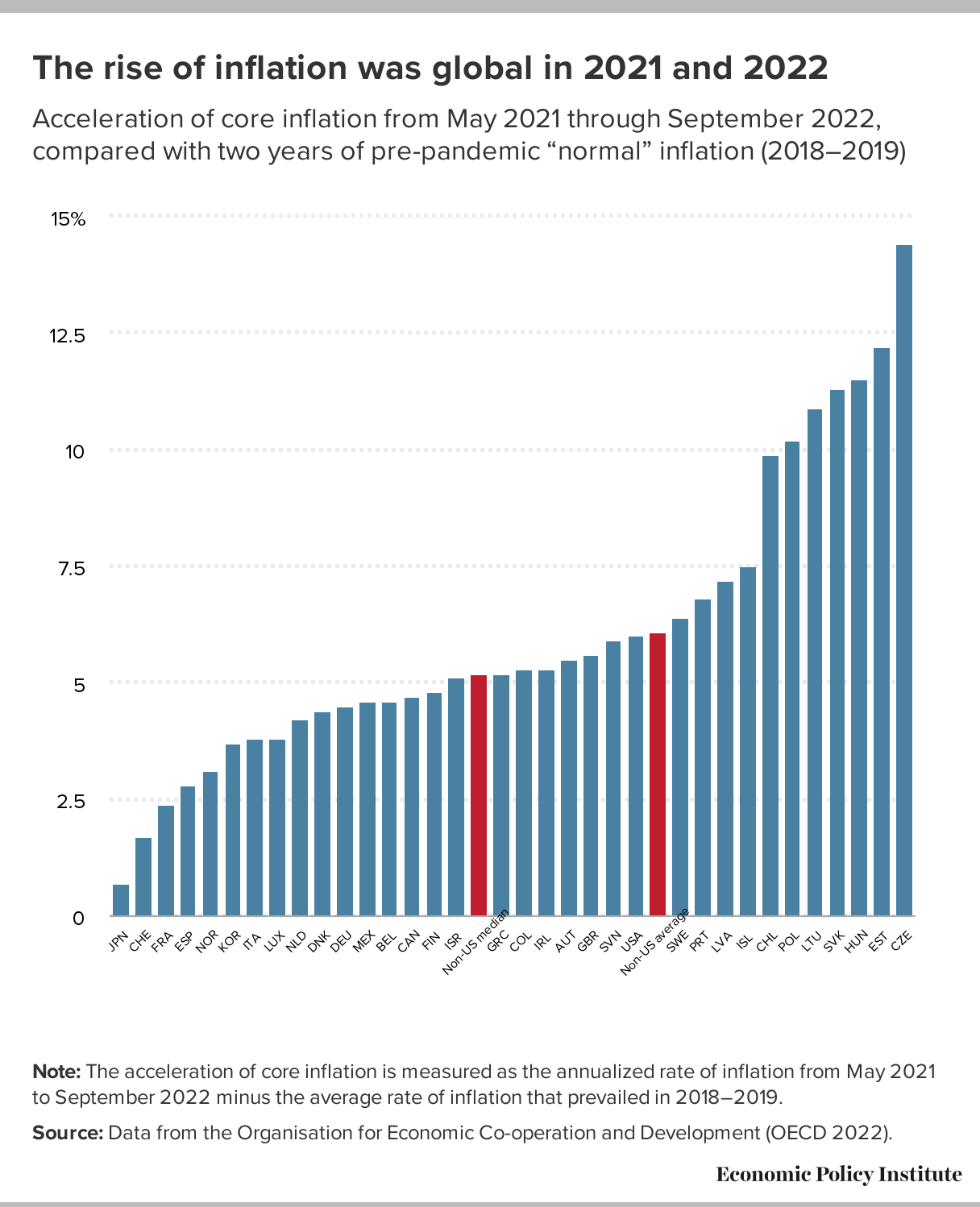

Inflationary forces are not confined to individual economies; they have implications on a global scale. International trade, exchange rates, and monetary policies across countries are interconnected. Analyzing the global economic landscape provides a comprehensive view of how inflationary forces reverberate across borders.

Investment Strategies in an Inflationary Environment

Investors navigate a different terrain during periods of inflation. Asset classes, such as commodities and real estate, may respond differently to inflationary pressures. Analyzing historical trends and employing diversified investment strategies becomes essential for investors seeking to hedge against the impact of rising prices.

Labor Market Dynamics and Wage Inflation

The labor market is a critical component in the inflationary equation. Wage inflation, driven by factors such as labor shortages or increased demand for skilled workers, can contribute to overall inflation. Understanding the intricate relationship between labor dynamics and inflation provides a holistic view of the economic landscape.

Consumer Behavior and Inflation Expectations

Consumer expectations and behavior play a significant role in the inflationary process. Analyzing consumer sentiment, spending habits, and inflation expectations helps forecast future trends. This understanding is vital for businesses and policymakers to adapt strategies and policies accordingly.

Mitigating Inflationary Pressures

Governments and central banks employ various measures to mitigate inflationary pressures. Fiscal policies, such as taxation and government spending, alongside monetary policies, contribute to stabilization efforts. Assessing the effectiveness of these measures provides insights into a nation’s resilience against inflationary forces.

Challenges and Opportunities for Businesses

Inflationary forces pose challenges for businesses, affecting production costs, pricing strategies, and overall competitiveness. However, astute businesses can identify opportunities amid inflation by adapting strategies, optimizing costs, and exploring innovative solutions to maintain resilience in dynamic economic environments.

Navigating the Future: Inflationary Forces Analysis

In conclusion, a thorough analysis of inflationary forces is essential for understanding economic dynamics, making informed policy decisions, and developing resilient financial strategies. To explore more on this topic and stay updated on the latest insights, visit Inflationary Forces Analysis. Understanding the intricacies of inflation is key to navigating the ever-evolving economic landscape.